Key Highlights

- Many buyers overpay by stretching their budget too far.

- Some choose the wrong area for long-term living or rentals.

- Not all real estate agents are trustworthy—do your homework.

- Skipping a full inspection can lead to hidden repair costs.

- Extra fees and taxes often catch buyers by surprise.

- Trusting the seller’s agent or inspector can backfire.

- Focusing only on looks, not function, leads to regret later.

- Buying without knowing future plans or zoning risks, long-term issues.

Mallorca has a property market full of opportunity, but it also has plenty of pitfalls if you don’t know what to look for. Many buyers make avoidable mistakes that can cost them thousands. Forgetting about legal obligations, ignoring hidden costs, or rushing into a deal without research can quickly turn your dream home into a stressful investment.

In this guide, we walk you through the five most common and expensive buying property in Mallorca mistakes people make, plus three lesser-known but critical ones drawn from real-life buyer experiences.

Schedule a meeting with an expert at Reiderstad Invest ⇒

1. Overlooking Legal and Tax Implications

Not understanding the legal framework of a property purchase in Mallorca can cause serious financial problems, especially if buyers overlook the value of the property and skip proper due diligence. Buyers often skip proper due diligence, only to find their new property has debts, fines, or legal restrictions attached, including the possibility of a demolition order.

Real Case: One international buyer purchased a countryside villa only to discover months later that it was under demolition threat due to non-permitted extensions.

Our Tip: Always request a nota simple from the land registry to check ownership, debts, and legal compliance. Work with a local solicitor to confirm tax liabilities and ongoing obligations, including IBI (annual property tax), wealth tax, and capital gains. Never skip this step, even if the home looks perfect on the surface.

2. Ignoring the Importance of Location

It’s easy to fall in love with a beautiful home, but if the location doesn’t suit your lifestyle, or the area is in decline, it may not be a wise investment.

Real Case: One couple bought a house based on its interior and sea views, but failed to realize it was on a flight path with planes overhead every 30 minutes (in high season, planes can fly overhead every 2-3 minutes).

Our Tip: Visit properties during different times of the day, week, and even season to understand traffic, noise, and activity levels. Ask your agent about future zoning changes or developments that could affect your view, privacy, or property value. Always align the property with your long-term lifestyle needs.

For example, areas in Mallorca that are close to the airport, such as Coll d’en Rabassa and Playa de Palma, may be too close to the airport for some people’s comfort. While most new constructions will have noise-canceling windows, it’s best to keep this in mind.

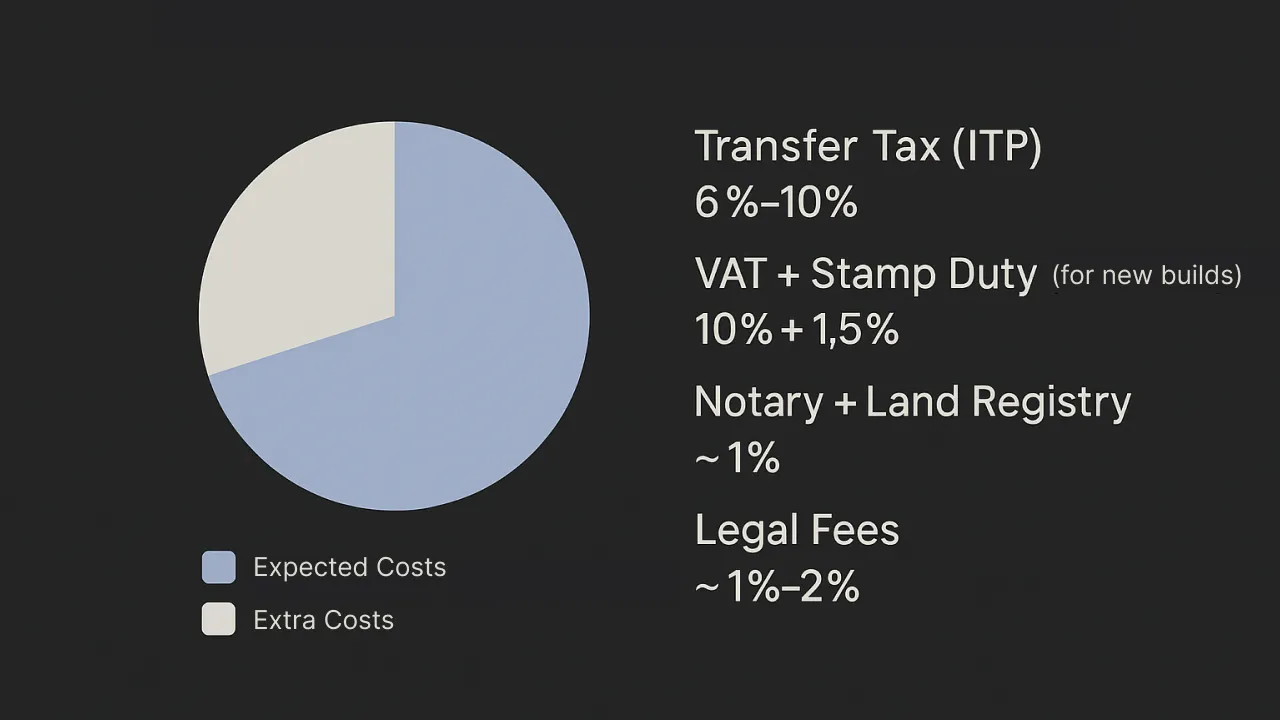

3. Failing to Account for Total Purchase Costs

Many buyers only budget for the purchase price and forget the additional 10–15% in transaction costs, including the sale price adjustments. These can include notary fees, stamp duty, property transfer tax, legal fees, and registration charges.

Real Case: A buyer was surprised to learn they owed over €40,000 in taxes and fees after purchasing a €400,000 villa. They had only budgeted for minor extras.

Our Tip: Use this breakdown as a general guide:

- Transfer Tax (ITP): 8%–13% (on average 10%)

- VAT + Stamp Duty (for new builds): 10% + 1.5%

- Notary + Land Registry: ~1%

- Legal Fees: ~1%–2%

Ask your agent to help you plan a full cost estimate before making any offer.

4. Not Conducting Thorough Property Inspections

Skipping a detailed inspection can leave you with costly surprises, such as poor wiring, water damage, or illegal structures.

Real Case: One buyer found extensive humidity damage in the roof three months after moving in. Their inspector had only done a surface-level check.

Our Tip: Hire a qualified, independent inspector who works only for you, not the seller or the agent. For rural or older properties, consider specialists for plumbing, electrical, roof, foundation, and drainage. Don’t waive the inspection under pressure.

5. Rushing Into Purchasing

Many buyers will rush the decision, fearing they’ll miss out or simply just too excited to move into their new home in Mallorca. But Mallorca’s market has cycles, and not all listings are priced fairly.

Real Case: A buyer paid 112% of the asking price out of fear of losing the home. Months later, the appraisal came in €100,000 lower.

Our Tip: Study local comps. Get to know prices by area. Ask your agent if the listing price aligns with past sales. Don’t rely on just one property; seek multiple options and get a feel for the market price of surrounding properties. In Mallorca’s market, knowledge is your leverage.

6. Not Checking the Neighbourhood

A home is not just about the building, it’s about what’s around it.

Real Case: A buyer had to sell their home after one year because a neighbor’s son ran a noisy scrap metal business in the garden at night.

Our Tip: Visit at all hours, walk the neighborhood, and ask locals what it’s really like. Search for future development permits in nearby lots, and use satellite maps to assess surrounding land use. Don’t be shy! If you’re planning on relocating to a new place, put in the effort; you’ll thank us later.

7. Trusting the Wrong People (Especially the Wrong Realtor)

Unfortunately, not all real estate agents in Mallorca are working with your best interests in mind. Some are more focused on closing a deal than finding you the right home, or giving you the full picture about the property and area. That’s why it’s essential to do your due diligence before choosing who to work with.

Here’s our selection of the top real estate companies in Mallorca ⇒

Real Case: A buyer skipped independent advice and trusted everything the seller and their agent claimed — including a “new” sewer line. It collapsed months later, leading to a major (and expensive) repair.

Our Tip: Don’t just take the first recommendation you get. Speak to recent buyers. Ask what their experience was like. Find an agency that has a strong reputation and genuine local knowledge. For example, at Reiderstad Invest, we know the Southwest of Mallorca inside and out — from the best school zones and quietest beaches to up-and-coming neighborhoods and top restaurants. That kind of insight means we can guide you to the right area for your lifestyle and investment goals, not just any available listing.

Always choose your own independent solicitor, surveyor, and inspector, people whose job is to protect you, not the deal. And if you’re buying in a community or complex, review the HOA rules (the homeowners associations, known as “Comunidad de Propietarios” in Mallorca, Spain) and financials before signing anything.

8. Stretching the Budget Too Far

Getting approved for a large mortgage can be exciting, but it doesn’t mean you should spend the full amount. Many buyers in Mallorca push their finances to the limit to secure a dream home, only to find themselves under pressure the moment unexpected costs arise.

Real Case: A couple bought at the very top of their budget and had no financial cushion left. Just three weeks after closing, one of them lost their job. With no emergency savings, they struggled to keep up with mortgage payments and daily expenses.

Our Tip: Always build in room for the unexpected — from rising property taxes and repair costs to life changes like job loss or starting a family. We recommend keeping at least 6–12 months of living expenses in reserve. Your first home doesn’t have to be your forever home. Focus on what’s financially sustainable today and allows room for growth tomorrow.

9. Not Thinking About Long-Term Livability

A home might feel like the perfect escape, but that doesn’t mean it’s ideal for full-time life. One of the most common mistakes we see in Mallorca is buyers choosing a property based purely on its holiday appeal, without considering how practical it is for everyday living.

Step inside this luxury villa for sale in Palma ⇒

Real Case: A couple bought a picturesque stone house in Valldemossa after falling in love with the views. But within months, they found themselves isolated during the winter season, with limited access to shops, schools, and services. Eventually, they sold and relocated closer to Palma.

Our Tip: Always match the property to your lifestyle goals. If your focus is on holiday rentals, charming towns like Deià, Sóller, Port de Pollença, and parts of the Tramuntana Mountains offer strong appeal for tourists — stunning views, peace, and traditional architecture. But keep in mind: these popular areas can feel a bit quiet and limited in winter, and may not be well-suited for permanent living.

On the other hand, if you’re looking for year-round comfort, areas like Bendinat, Illetas, Costa d’en Blanes, Santa Ponsa, and Palma offer far more convenience. These places have reliable infrastructure, international schools, healthcare, shops, and good transport, making them ideal for families, professionals, or retirees staying all year.

At Reiderstad Invest, we help our clients think beyond the brochure and choose properties that fit their actual lifestyle — whether it’s a holiday investment or a long-term home base in Mallorca.

Explore properties for sale in top areas of Mallorca ⇒

How to Avoid Buying Property in Mallorca Mistakes

No matter how beautiful a home may look or how tempting the location sounds, buying property in Mallorca requires more than a gut feeling. It takes proper planning, due diligence, and guidance from experts who truly understand the local market.

At Reiderstad Invest, we’ve seen firsthand how costly even small oversights can be. That’s why we don’t just help you find a property, we guide you through the entire process with clarity, honesty, and local expertise.

Explore our properties for sale in Mallorca ⇒

Here’s how we help our clients avoid these mistakes:

- We do the groundwork with you: From verifying zoning and checking for hidden legal issues to helping you understand which areas fit your lifestyle best, our job is to think ahead so you don’t have to backtrack.

- We only show you what makes sense: Every property in our portfolio is handpicked. We don’t waste your time with places that don’t align with your goals.

- We connect you to the right people: Whether it’s an independent solicitor, a trusted building inspector, or a skilled interior designer, we bring in professionals we’d use ourselves.

- We help you look beyond the sale: Our services go well beyond the transaction. We help with everything from renovations and project management to ongoing property care, so your investment stays secure and stress-free.

With deep local knowledge, particularly in areas in the Southwest like Illetas, Old Bendinat, and Palma Old Town, we help buyers find properties that are not only beautiful but also make sense financially, legally, and practically.

If you’re ready to invest in Mallorca and want expert guidance from day one, talk to us. We’re here to help you avoid the common pitfalls and find a home or investment that truly fits your vision.

Get in touch with Reiderstad Invest today ⇒

Conclusion

To sum it all up. Avoiding the big mistakes shared in this blog can help you save a lot of time, money, and stress when you are buying property in Mallorca. Understanding the legal side, local regulations, and doing your homework about the real estate market and neighborhood are important.

Every step matters to be sure the process goes well. When you are careful and know what to look for, you can deal with the real estate world more easily. Keep in mind that buying property is one of the biggest things you can do with your money, so you want to be sure. If you want advice made just for you, talk to our team of experts and get a free meeting today!

Frequently Asked Questions

What are the hidden costs in buying property in Mallorca?

Hidden costs can be higher than you may think. There is stamp duty, which is usually about 0.5%. You also have to pay notary fees for the sale papers and an annual property tax each year. If you sell the home later, there will be a capital gains tax to pay. Other additional costs can come up with financing deals.

You should expect some extra fees too. These may be things like registration fees and payments for legal services. Knowing about these up front will help you not get surprised later on.

How long does the property buying process take in Mallorca?

The property purchase process in Mallorca often takes about 6 to 12 weeks. The time depends on things like getting your financing ready, completing tasks at the registry, and getting the next step, which is a public deed of sale that is notarized. , as well as the payment of additional costs, such as AJD. This process could be longer if you need more papers or if some approvals are not yet in.

Is it worth buying property in Mallorca?

Investing in the real estate market of Mallorca can give you good returns. You also get to enjoy a great lifestyle. Areas like Palma and Pollensa have strong demand, so property values command a higher price and stay up. This makes it a good idea to think about long-term real estate investments in the Balearic Islands.

What documents do I need when buying a property in Mallorca?

Some important documents you need are the public deed of sale, land registry papers, bank financing agreements, and identification like your passport. If you are one of the international buyers, you may need extra checks for your documents. To make the process of gathering the needed paperwork easier, it is a good idea to talk to legal advisors about what you must have.