What’s the true cost of buying and owning property in Mallorca?

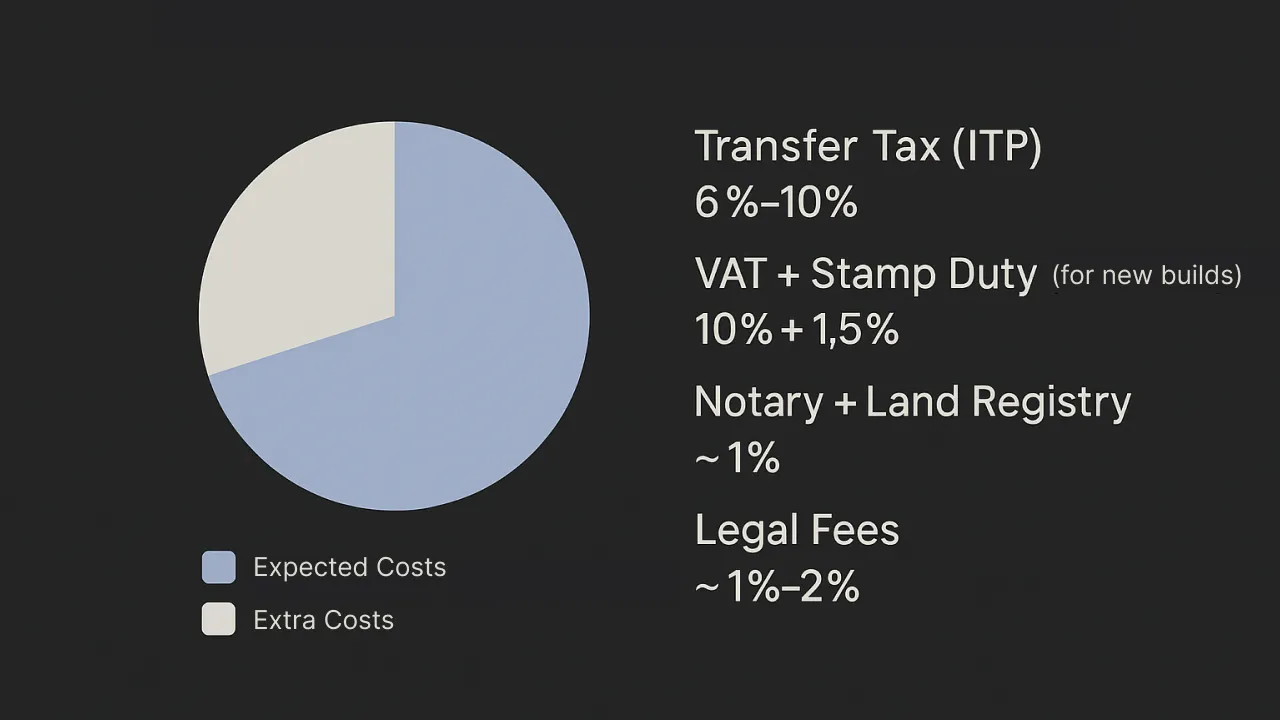

The true cost of buying property in Mallorca goes far beyond the purchase price. Buyers should budget an additional 10–15% of the property’s value to cover taxes like ITP (up to 13%) or VAT + stamp duty (up to 11.5%) on new builds, plus notary, legal, registry, and agent fees. Ongoing costs include annual property taxes (IBI), community fees, utilities (~€250/month), insurance, maintenance, and rubbish tax, with optional extras for rental licenses and management. Capital gains tax applies when selling, ranging from 19% to 26% based on profit.

26 Expenses That Influence the True Cost of Buying Property in Mallorca

Due to the high demand for property buying in Mallorca and the large number of buyers looking to invest in this slice of paradise, it can be difficult to understand the actual cost of buying property in Mallorca. Here, we break down every potential expense involved in buying a property in Mallorca.

1. Purchase Price of the Property

The agreed purchase price is, of course, the largest and most obvious cost when buying a property. However, understanding the true range of current prices in Mallorca can help buyers make smarter, more informed decisions.

According to the 2024–2025 Engel & Völkers Market Report:

- Average asking prices for villas in top locations such as Son Vida and the Southwest (Port Andratx, Santa Ponsa, Portals) exceed €7.5 million.

- Villas in very good locations (Palma surroundings, North Mallorca, parts of the Southeast) range between €2.5 million and €4.5 million.

- In good to average areas, villa prices typically range from €1.3 million to €2.5 million.

- For apartments, average prices in Palma’s top seafront or historic areas range between €1.1 million and €2.3 million, while good-value areas still hover between €450,000 and €750,000.

Whether you’re buying a modern villa, rustic finca, or seafront apartment, it’s crucial to assess the location, condition, and lifestyle appeal in addition to headline price.

Explore our collection of exclusive properties for sale in Mallorca ⇒

2. Real Estate Agent Fees

At Reiderstad Invest, we don’t just help you find a property — we guide you through the entire lifecycle of home ownership in Mallorca. From acquisition to renovation, interior design, rentals, and ongoing property management, our service is designed for international buyers who value quality, discretion, and long-term support.

Our real estate commission (like most real estate agencies in Mallorca) typically ranges between 3% and 5% of the total purchase price, depending on the property and scope of service. This fee is often negotiable, especially for clients engaging our broader suite of services.

At Reiderstad Invest, many of our listings are exclusive and not available elsewhere — a rarity in Mallorca. With experience supporting international buyers, especially from Scandinavia, Germany, the UK, and the US, we offer not just purchase support but also help with rentals, interior design, and long-term property management.

Tip: Always clarify whether your agent is acting solely on your behalf or also representing the seller. At Reiderstad Invest, we prioritise transparency and alignment with our clients’ interests — always.

3. Property Transfer Tax (ITP)

Property transfer tax (ITP) is one of the biggest costs for property buyers in Mallorca. It depends on the agreed purchase price of the property. Because of this, it is important for buyers to be aware of this tax before they buy.

If you’re buying a resale property in Mallorca (not a new build), you’ll need to pay Property Transfer Tax, known as ITP. This is a progressive tax, meaning different portions of the purchase price are taxed at different rates:

- 8% on the first €400,000

- 9% from €400,001 to €600,000

- 10% from €600,001 to €1,000,000

- 11% from €1,000,001 to €2,000,000

- 13% on anything above €2,000,000

Example:

If you buy a property for €495,000, you’ll pay:

- 8% on the first €400,000 (€32,000)

- 9% on the next €95,000 (€8,550)

- Total ITP: €40,550

Note: If you’re buying a primary residence for under €270,151.20 and meet certain conditions, you may qualify for a reduced 4% rate.

4. VAT (IVA) on New Builds

If you’re buying a newly built property in Mallorca — directly from a developer — you’ll need to pay VAT (known as IVA in Spain) instead of the standard ITP tax used for resale properties.

- VAT is charged at 10% of the purchase price.

- You’ll also need to pay Stamp Duty (AJD), typically 1.5% in the Balearic Islands.

So, if you’re buying a newly built villa for €1,000,000:

- VAT would be €100,000

- Stamp Duty would be €15,000

- Total tax: €115,000

Note: VAT does not apply to resale properties — those are taxed under the ITP system instead.

5. Notary Fees

Notary fees are one of the key costs to consider when buying property in Mallorca. In Spain, the notary handles many of the legal duties that a solicitor might cover in other countries. They draft the public deed of sale, verify documents, and ensure the transaction meets all legal requirements.

- Notary fees in Spain are regulated by the government, so prices are relatively standard across the board.

- Costs depend mainly on the property value and the complexity of the transaction.

- Expect to pay anywhere from €400 to €1,500 in most cases.

For example:

- A property worth €100,000 might have a notary fee of around €850

- A €250,000 property could result in a fee of about €1,000

- Larger or more complex purchases (e.g. luxury villas) will sit at the higher end of the range

Additional factors can influence the final fee:

- The number of people involved in the transaction

- The total number of pages in the public deed

- Special clauses or financing arrangements included in the contract

Notary fees are usually paid by the buyer and are required to complete the registration of the property. It’s a fixed part of the process, so make sure to include it in your upfront budget.

6. Land Registry Fees

Step inside this luxury villa for sale in Costa D’en Blanes ⇒

When you buy real estate in the Balearic Islands, you need to register it with the Land Registry. This step shows that you own the property. Registering your property with the Land Registry is a required step after signing the public deed. This officially records you as the legal owner and protects your rights if disputes or issues arise in the future.

- Land Registry fees in the Balearic Islands typically range from €300 to €1,200, depending on the property’s value and location.

- For example, a property worth around €250,000 may incur a registry fee of about €500–€600.

- More expensive or complex properties will fall closer to the upper end of the range.

After the notary certifies the deed of sale, registration should be completed as soon as possible. Delaying this step can lead to administrative issues or fines.

- Tax authorities also review the registered documents to confirm that the declared purchase price matches official records.

- The registration is usually handled by your legal representative, but the cost is paid by the buyer.

It’s a small but essential part of the process — and one that gives full legal security to your investment.

7. Legal Fees and Due Diligence

Legal fees are an inevitable part of purchasing a property in Mallorca. Most buyers set aside approximately 1% of the property’s value, plus VAT, to cover these costs. Working with legal advisors can help reduce risks during the due diligence process. These steps include checking the land registry and identifying any additional hidden costs.

It is especially important to have lawyers who know the purchase process and the tax system if you are buying luxury villas or secondhand homes. They ensure that you follow the laws of the Balearic Islands. They also protect you from potential problems.

Once due diligence is complete, legal advisors will assist you with finalizing contracts and handling paperwork. These steps help ensure smooth transactions. This allows buyers to focus on other costs, such as loan fees, and proceed with peace of mind.

8. Mortgage Arrangement Fees

When applying for a mortgage in Mallorca, one cost to factor in is the mortgage arrangement fee — the charge banks apply for processing your loan application and setting up the contract.

- This fee typically ranges from 0.5% to 1% of the loan amount, depending on the lender, the loan type, and your personal profile.

- It’s a one-time cost, regulated under Spain’s Mortgage Act (in force since June 2019), which means banks can no longer add separate charges for initial studies or admin services.

For example:

- A €500,000 mortgage could result in an arrangement fee of €2,500 to €5,000, unless waived.

Some banks, like CaixaBank, may offer zero arrangement fees for certain mortgage products, such as the “Hipoteca CasaFácil” or “Hipoteca Eficiente” — as seen in their current offer. However:

- Other fees still apply, such as property valuation, notary costs, or in the case of the Hipoteca Eficiente, a €605 expert fee for managing energy-efficiency improvements (listed as €500 + VAT).

Key tip:

- Always check whether the mortgage offer includes bonifications (discounts) based on conditions like direct debit setup or home insurance, as these can influence both interest rate and fees.

- Ask the bank to give you a FEIN (Ficha Europea de Información Normalizada) — a standardised information sheet — to clearly see all upfront costs and conditions.

Including this in your purchase budget helps avoid surprises and ensures you’re comparing loan offers properly.

9. Bank Charges for International Transfers

Transferring money internationally is a key step for many foreign buyers purchasing property in Mallorca. While it’s a common and secure method of payment, especially for large sums, it can come with hidden costs if not handled carefully.

Bank charges vary depending on several factors:

- SEPA transfers (within the Eurozone and in euros) are generally low-cost or free, especially if done via online banking.

- Non-SEPA transfers, like those from the UK or US, tend to incur higher fees and less favorable exchange rates.

The fee structure used also affects the final cost:

- OUR: the sender pays all transfer fees

- SHA: the sender and receiver split the fees

- BEN: the recipient pays all fees

To reduce transfer costs:

- Use online or mobile banking instead of in-branch transfers

- Compare banks

- Be strategic with the currency exchange, locking in rates when favorable

For high-value transfers, especially final payments at closing, most buyers use standard bank transfers or even Bank of Spain transfers (OMF – Orden de Movimiento de Fondos) for same-day processing.

Tip: while not legally required, opening a Spanish bank account can make managing payments and ongoing property costs (like utilities or community fees) much easier.

Working with your legal advisor or financial planner can help ensure your transfers are efficient, cost-effective, and secure.

10. Surveyor and Valuation Fees

Before finalising a property purchase in Mallorca, it’s a smart move to get a professional valuation and, in some cases, a full survey. These services help you understand the true condition and market value of the home — and can save you from costly surprises later.

- A valuation is often required by banks if you’re applying for a mortgage. It tells you what the property is worth based on market conditions.

- A survey goes deeper, checking the structure, condition, and any possible issues with the building. While not required by law, it’s highly recommended — especially for older or rural homes.

Valuations are best done before signing the deposit contract (arras). This gives you a solid market estimate and can help in negotiations.

Typical cost:

- Most property valuations in Mallorca cost between €300 and €500

- The price depends on the size, complexity, and location of the property

The final report will include the estimated value of the home, which the bank then uses to calculate how much it’s willing to lend.

Including this step in your buying process gives peace of mind and helps ensure you’re paying a fair price.

11. Stamp Duty (Actos Jurídicos Documentados)

Stamp Duty, known in Spain as AJD (Impuesto de Actos Jurídicos Documentados), is another tax to consider when purchasing property in Mallorca. It’s applied to the official notarial documents that formalise the sale — including the deed of sale and, if applicable, the mortgage deed.

- In the Balearic Islands, Stamp Duty is currently set at 1.2% of the purchase price.

- This applies to new builds and is paid in addition to VAT (not ITP).

- For resale properties, AJD may still apply to certain parts of the transaction, but the primary tax is ITP.

Who pays AJD?

- For a property purchase, the buyer pays the stamp duty.

- For a mortgage deed, under current law (post-2018), the bank is responsible for paying AJD.

Here’s an example of stamp duty tax (ADJ):

If you’re buying a newly built property for €850,000:

- Stamp Duty = 1.2% of €850,000 = €10,200

Since AJD is managed regionally, it’s always worth checking if you’re eligible for any reductions or exemptions, such as for:

- First-time buyers

- Purchasers under 30

- Large families

- People with disabilities

- Officially protected housing (VPO)

Your legal advisor or real estate agent should confirm the applicable rate and ensure payment is made on time, typically at the same time as registering the deed with the Land Registry.

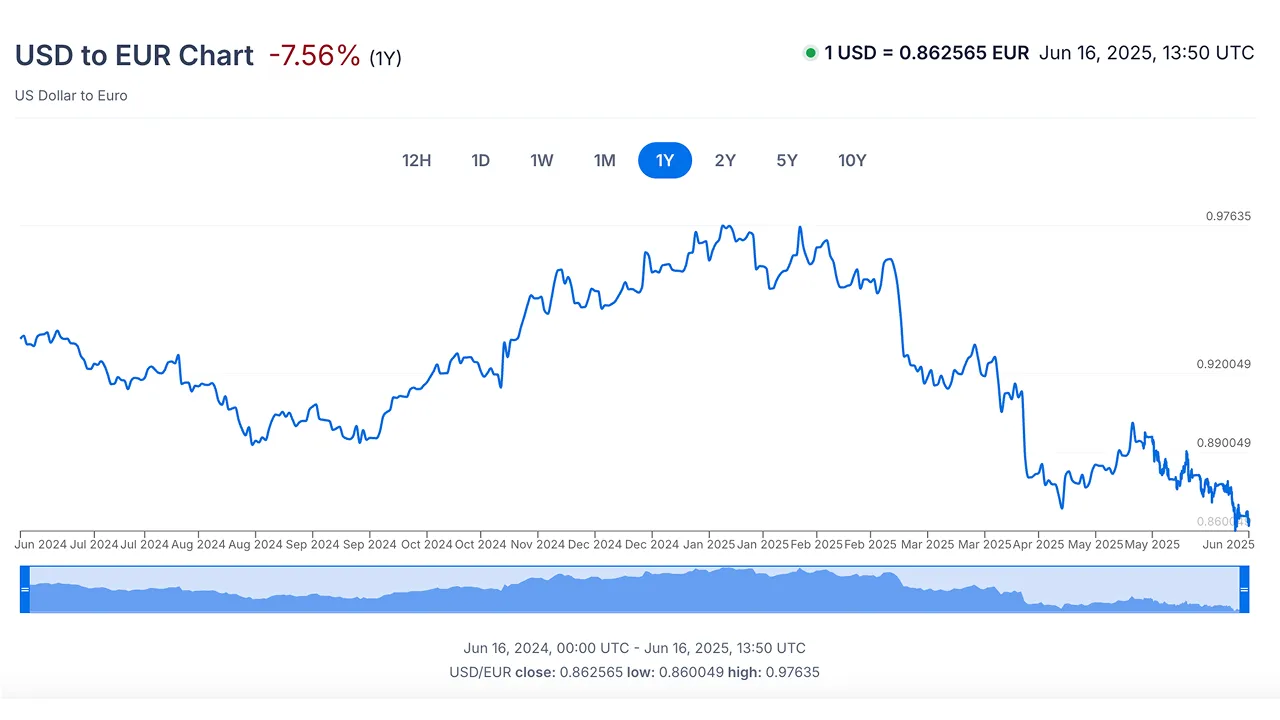

12. Currency Exchange Costs

When buying property in Mallorca, currency exchange costs can have a significant impact, especially if you’re transferring large amounts from outside the Eurozone.

Even small changes in the exchange rate can result in thousands of euros in difference:

For example, on a €1,000,000 property purchase:

- At 1 EUR = 1.07 USD, you’d need approx. $1,070,000 USD

- If the rate dropped to 1.03, you’d need $1,030,000 — a difference of $40,000

As of today, June 16, 2025, here are the current exchange rates:

- 1 EUR = 0.84 GBP

- 1 EUR = 1.07 USD

Banks typically add a 2%–3% markup to the mid-market rate. This is where hidden costs can sneak in.

To reduce costs:

- Look into locking in a rate in advance (forward contract) if you’re buying months ahead

- Transfer in euros whenever possible if you already hold euro funds to avoid conversion altogether

Currency risk is often overlooked, but getting this right can save you enough to cover other buying costs like notary fees or legal services. Always check real-time rates and plan ahead with your legal or financial advisor.

13. Home Insurance

Home insurance is a smart and often essential step when buying property in Mallorca. It protects both the building and your belongings from risks like fire, water damage, theft, or extreme weather — all of which can occur in the Balearic Islands.

How much does home insurance in Mallorca cost?

- Most home insurance policies in Mallorca range between €150 and €500 per year

- The final price depends on the Type and size of the home (apartments are cheaper than villas), level of coverage (basic vs. full protection), and the insurance provider

Tips:

- Always compare quotes from multiple insurers

- Review the coverage to avoid overpaying for what you don’t need

- Some areas may carry higher premiums due to flood risk or remoteness

14. Community Fees (for Apartments/Gated Communities)

Step inside this direct sea access apartment in Illetas ⇒

If you’re buying an apartment or property in a gated community in Mallorca, you’ll need to budget for monthly community fees. These cover shared services like:

- Maintenance of gardens, pools, elevators, and hallways

- Cleaning and repairs

- Security and sometimes concierge services

Fees are mandatory under Spanish law and help keep the building and common areas in good condition.

How much do community fees cost in Mallorca?

- On average, expect to pay between €100 and €315 per month

- The amount is based on your ownership share, or “coeficiente de participación,” which depends on your unit’s size, location, and use of communal facilities. This should all be listed in your property deed

Our tip:

The more amenities your community has (like pools, gyms, or landscaped areas), the higher the fee. Always ask for the exact monthly or annual cost before buying, so you understand your total ownership expenses.

15. Annual Property Taxes (IBI)

One of the key ongoing costs of owning property in Mallorca is the IBI (Impuesto sobre Bienes Inmuebles) — the annual local property tax. It’s paid by the property owner and applies to all types of real estate: apartments, houses, parking spaces, offices, and more.

What determines the cost of IBI?

- The amount is based on the cadastral value of the property, not the market price

- Each local council sets its own rate, so the amount varies depending on the municipality

Typical costs of IBI in Mallorca:

- For a small apartment (around €450,000 market value), the IBI usually ranges between €320 and €800 per year

- For high-end properties or villas, the amount can be significantly higher

Tip:

The exact figure will appear in your annual property tax bill. Ask the seller or your agent for the latest IBI receipt during the buying process — this gives you a clear idea of what to expect. Also note that some towns offer discounts for early payments or energy-efficient homes.

16. Rubbish Collection Tax

In Mallorca, homeowners pay a local waste tax for rubbish collection and disposal. This fee is based on how much waste your property generates and how it’s processed (landfill or incineration).

As of 2025:

- €20–€40 per tonne for landfill

- €10–€20 per tonne for incineration

The exact cost depends on your municipality and if it offers organic waste recycling. For most homes, expect an annual increase of around €30. This fee is often included in your local utility bill or community fees.

Real examples (2025 estimates):

- Typical 70m² apartment: approx. €30 more per year due to recent increases.

- Cafeteria over 100m²: approx. €700 more annually.

- Supermarket (250m²): could see increases of over €1,000/year.

Good to know:

- This tax is in addition to other local service fees.

- It’s mandatory, and non-payment could result in fines.

- The tax is managed by ATIB, the Balearic tax authority, and is subject to changes via the regional budget each year.

Tip: If you’re buying in a gated community or apartment building, this cost might be included in your community fees — ask the property manager or real estate agent for clarification.

17. Utility Connection and Setup Fees

Utility connection and setup fees often catch new property buyers by surprise during the buying process. These fees cover the installation of utilities such as electricity, water, and gas. These costs can vary based on the location of the property and the utility provider.

It is important for property buyers to be aware of these expenses. Knowing about these expenses helps people plan their budget and avoid being caught off guard by a large bill when buying real estate in Mallorca. These costs can add up and increase the property’s price.

Working with a real estate agent can help you understand and manage these fees. An agent with good knowledge of the area will guide you through the process to ensure a smooth experience. This is one way to ensure a smooth experience for everyone involved in buying real estate in the Balearic Islands.

18. Ongoing Utility Bills

Regular utility bills are a normal part of owning a property in Mallorca. You need to pay each month for water, electricity, and gas. These costs go up or down, depending on how much you use. So, it is good to keep an eye on how you use these In Mallorca, monthly utility bills are typically higher than in mainland cities like Madrid or Barcelona, mainly due to island logistics and climate.

Here’s what you can expect to pay for an average 85 m² apartment:

- Basic utilities (electricity, heating, water, rubbish): approx. €193/month

- Internet (60 Mbps+, unlimited data): around €36/month

- Mobile phone plan (calls + 10GB+ data): about €20/month

Actual costs will vary based on usage, property size, and energy efficiency, but these averages give a solid baseline for budgeting.

19. Maintenance and Repairs

Owning a property in Mallorca comes with year-round upkeep — from pool care and garden maintenance to storm damage and regular checks on utilities. For second-home owners, especially those abroad, this can be a constant concern.

At Reiderstad Invest, we offer full maintenance services to keep your property in excellent condition. Our team handles everything from weekly inspections, repairs, and pest control to garden upkeep, pool cleaning, and key management.

Whether it’s a quick fix after a storm or preparing your home for your arrival, we act as your local point of contact, so you can enjoy your property without the stress of managing it.

Get in touch with a realtor at Reiderstad Invest for a quote ⇒

20. Pest Control and Prevention

If you want to maintain a high property value in Mallorca, especially across the green lands of Mallorca, it is important to keep your place free of pests. Regular checks and pest control can help you prevent problems before they start. This will help you avoid large repair bills that could lower your property value in the future.

The right plan for you depends on the location and type of property. You may only need simple inspections, or you may need to combat common pests like termites or mice. When you team up with local experts, you get options suited to the Mediterranean climate. This gives homeowners peace of mind and helps them take care of their property.

21. Humidity and Damp Treatment Costs

Take a look at this elegant apartment in Santa Maria, Mallorca ⇒

Due to Mallorca’s coastal climate, humidity and dampness are common challenges for homeowners. Left untreated, they can lead to mould stains, bad odours, peeling paint, and even leaks or water infiltration, especially if the problem is ignored for too long.

The best time to treat damp is as soon as the first signs appear. Early action helps stop the spread of stains, prevents further damage to walls, and avoids costly water ingress repairs down the line.

Treatment costs depend on the type and severity of the issue. Prices typically range from €30/m² to €140/m², with an average of €75/m². Regular inspections and timely interventions are essential to protect your property and preserve its value in Mallorca’s humid environment.

22. Structural Repairs, Renovations, and Legal Inconveniences

The cost of structural repairs and renovations in Mallorca can significantly increase the total investment required, especially for older homes, rural properties, or those needing modernisation. Common issues include damp walls, cracked foundations, outdated plumbing, or damaged roofs, and all require immediate attention to avoid bigger problems down the line.

But cost isn’t the only factor. Legal limitations can also play a major role, particularly if the property includes any “out-of-plan” constructions (construcciones fuera de ordenación). These are illegal under the Urban Planning Law of the Balearic Islands (LUIB), even though they may still be bought and sold.

Owning such properties comes with real risks:

- You may not be allowed to renovate, expand, or even repair certain parts of the property.

- Even basic fixes, like repairing a leaking roof on the illegal section, can be prohibited by law.

- Over time, this can lead to deterioration and loss of property value.

- In some cases, these properties also carry unpaid urban planning fines, adding thousands of euros in hidden costs for the new buyer.

If you’re buying a rural finca or a home with additions, always request:

- An urban adequacy certificate from the local council, or

- An architect’s legal report verifying that all structures are compliant.

Skipping this step could result in extra renovation costs, stalled building plans, or worse — a property that can’t be legally improved or insured.

In short, always factor in not just the physical cost of renovations, but also the legal status of the buildings before buying.

23. Security Systems and Upgrades

Although Mallorca is considered an extremely safe place to live, it’s always best to be cautious. That’s why investing in security systems and upgrades is a good idea.

These systems help protect your property and make it safer for everyone. Adding alarm systems, cameras, and access control can give you more peace of mind.

Many international buyers now look for luxury villas in good areas. These security upgrades can make your property stand out in a busy real estate market. When your home is secure, it’s easier to rent it out. Guests who care about their safety will be happy to choose your place for their stay.

24. Property Management Fees (if renting out)

Managing a property in Mallorca for rental purposes may incur additional costs on top of the overall price of buying real estate. If you are a foreign buyer, it is advisable to work with a property management company to ensure compliance with local regulations and maximize your rental income.

Typically, these companies charge a fee ranging from 10% to 20% of your rental income. This fee may cover advertising, screening tenants, and property maintenance. Knowing about these regular costs is important for planning your budget and ensuring you get the best results from your rental in the real estate market.

25. Holiday Rental License Fees

Holiday rental license fees in Mallorca can change the real estate costs you have to pay. These licenses are needed if you want to rent your place to tourists. The tax authorities in the Balearic Islands have strict rules for this. The fees for these licenses depend on things like where the place is and what type of property you have.

This adds more steps when you buy in the real estate market. You need to follow the regulations to stay away from big fines. You should also do this because it makes your property more attractive compared to others in the Balearic Islands. If you know what the rules are, the process gets easier. For property buyers who want to attract vacationers, sorting all this out early is a good idea.

Note: Holiday rental licenses are no longer being issued. However, you can still purchase a property that has an existing license attached to it.

26. Capital Gains Tax on Future Sale

When you sell a property in Mallorca, you need to think about capital gains tax. It is charged on the money you make from the sale.

If you sell your property in Mallorca for more than you paid, you’ll owe capital gains tax on the profit. This tax is part of your Spanish income tax (IRPF) and applies to any increase in the property’s value at the time of sale.

Similar to the ITP, capital gains are taxed progressively:

- Up to €6,000: 19%

- From €6,001 to €50,000: 21%

- From €50,001 to €200,000: 23%

- Over €200,000: 26%

Here’s an example of how the property gains tax works in Mallorca:

If you sell and make a profit of €250,000, you’ll be taxed:

- 19% on the first €6,000

- 21% on the next €44,000

- 23% on the next €150,000

- 26% on the final €50,000

If you sell at a loss, you can offset that amount against other capital gains on your tax return.

Tip: Always keep records of improvement costs, agent fees, and taxes — they can reduce your taxable gain.

Key Factors That Influence Property Prices in Mallorca

Many things can affect property prices in Mallorca and shape the real estate market here. The most important factor is location. Places like the city centre of Palma de Mallorca and areas by the coast, such as Santa Ponsa or Costa D’en Blanes, usually have higher prices. This is because they offer the views and proximity to beaches.

Location and Neighborhood Desirability

In Mallorca, location is key. Areas like Santa Ponsa or Cala Vinyes near beaches, schools, and hospitals tend to have higher property prices. Sea views, walkable beach access, and nearby amenities are especially sought after by buyers.

Proximity to Beaches, Airports, and Amenities

Properties close to beaches, the airport, and top attractions are in higher demand and command premium prices. These are especially attractive to foreign buyers and investors.

Property Type: Villa, Apartment, Finca, or Townhouse

Mallorca offers a wide range of properties:

- A villa can range from €1.3 million in average areas to over €7.5 million in top coastal zones like Son Vida or Port Andratx.

- An apartment can cost anywhere between €450,000 and €2.3 million, depending on whether it’s in a standard neighborhood or a prime seafront spot in Palma.

- A finca (rural home) varies widely, but renovated ones with land often match villa pricing, especially in desirable inland or hillside areas.

- A townhouse tends to be more affordable than a villa, with prices depending on size, location, and whether it’s been renovated or not, typically below villa but above high-end apartment costs.

Choosing the right type depends on lifestyle and investment goals.

Conclusion

Navigating the real estate market in Mallorca can be tricky because many factors can influence property prices. Beautiful beaches and popular areas both play a role in determining what someone will pay. Foreign buyers and those living in the Balearic Islands should be aware of these factors, especially in this extremely fast-paced market.

To get a good deal, you need to understand the entire real estate process. This means learning about property transfer tax and all the associated costs. Understanding the complexity of the transaction can help you make better choices when buying or selling.

As more people from around the world want to live in the Balearic Islands, it is important to keep track of market trends. This will help us all make great investments that will grow over time in this amazing place.

Frequently Asked Questions

Is it more expensive for foreigners to buy property in Mallorca?

Foreigners might have to pay extra costs to buy a home in Mallorca. There are higher taxes and fees for them. But the total price will change depending on the type of place you want and where it is.

What are the typical hidden costs buyers overlook?

Many buyers do not see some costs at first. These can be things like property transfer taxes, fees to set up local utilities, and the money you spend to keep up the place. Your insurance premiums and any fees for the community also make a big difference to the total amount you have to pay. You need to think about all of these things so you will not be caught by surprise with extra money problems.

Can I get a mortgage as an American buying in Mallorca?

Yes, if you are from America and want to buy a home in Mallorca, you can get a mortgage. Many banks in Spain give mortgages to people who do not live there full-time. These loans usually cover about 60–70% of the property value. You will need to give the bank some papers about yourself. Also, the interest you pay may be higher than what local people get.

Are there recurring taxes after purchasing a home in Mallorca?

Yes, after you buy a home in Mallorca, you have to pay property taxes every year. You also need to pay a rubbish collection tax and community fees. On top of that, you have to keep up with utility bills for things like water and electricity. It is good to keep all these in mind when making a budget so you can keep your place well-maintained.